Your Home Buyers Credit Score

Stan Direct: 604-202-1412

E-mail: [email protected]

Stelli Direct: 604-202-4141

E-mail: [email protected]

Your Home Buyers Credit Score. How it works.

For many of us, debt is a way of life. Installment payments and credit cards can be useful financial tools. But if not controlled, credit can eventually control you. To qualify for a mortgage loan, your credit history doesn’t have to be spotless, but your history must clearly show your willingness to pay your debts.

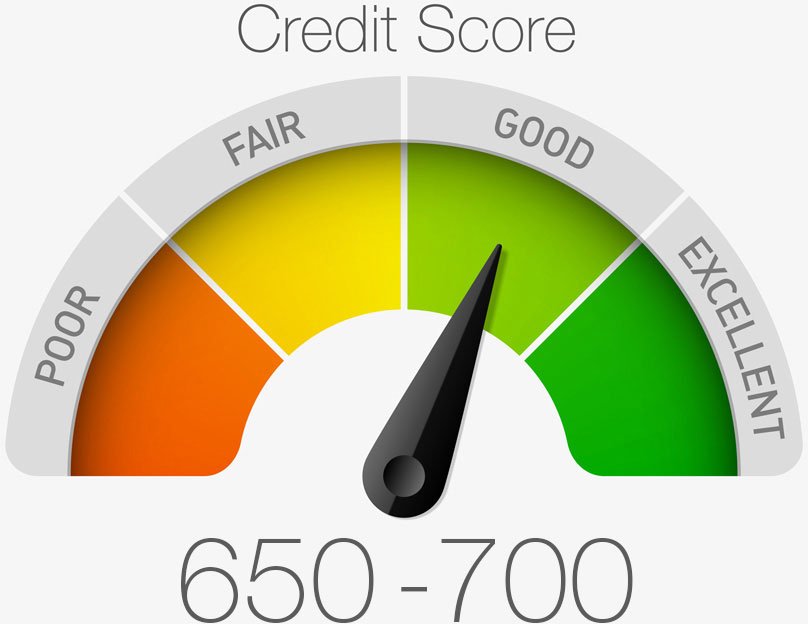

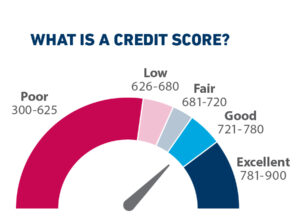

In Canada, credit scores range from 300 to 900, 900 being a perfect score and 300 the lowest.

According to data from a 2022 survey, the average credit score in Canada is 672, and 694 in British Columbia.

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards, as well as the interest rate you get.

What is a good credit score in Canada

Your Home Buyers Credit Score is shown on the Credit Report

When you apply for a mortgage loan from any lender, they’ll look at your credit record to see if you’ve been responsible about managing your debts. Your credit record can be obtained from a credit bureau – an agency that gathers statistics on individual payment records on loans, credit cards and other debts. Federal law gives you the right to review your credit record, and it’s smart to do so before you apply for a loan. Most credit reporting agencies won’t give you credit information over the telephone, but you may request your credit report in writing or in person. If you do it in person, be sure to take along identification. For a small fee (from $8 and up), the agency will give you a complete report that shows your current debts and payment history.

When you get your credit report, look at it carefully for any past-due or written-off amounts. Remember that poor credit will prevent you from qualifying for a loan. Make sure the credit report’s information about you is correct. Your lender may need a written explanation for any late payments. Because credit reports usually list account numbers, loan terms and various codes, you may find your report a little confusing. Your lender can help you go over your report and explain any items that aren’t clear.

Correcting Credit Problems

If your credit report includes little or no information, include letters of reference from a lender or landlord to demonstrate your payment history. This information will become part of your application for a mortgage loan, and typically, in these situations, a larger down payment would be

required.

If you have a credit problem because of an unusual situation, write a letter of explanation. Your lender may overlook a credit problem if you can give a good reason for not making your payment. If you normally pay your bills on time but failed to pay one because of an unusual or temporary situation, write a letter that explains in detail why your payment was late. This letter will become part of your loan application.

If you’re constantly struggling to pay your bills, seek professional help. Organizations exist which can help you develop a solid plan for regaining control of your finances. It’s important to let your creditors know if you’re having problems making payments. In many cases, creditors will help you relieve your situation. Remember: creditors don’t want to lose money, and they want to help you pay them back. For example, some bank credit card companies will reduce your monthly payment and give you more time to pay if they know you’re having problems meeting your current payments.

Understanding the Home Buyers Credit Score

Incurring debt is part of life for most people. Understanding how best to handle credit will help you maintain control of your overall financial situation. Strong credit leads to quick credit approval at the best possible terms. Your credit history must clearly show your willingness and ability to pay your debts.

Your Credit Report

• During the application process, lenders look at your credit record and credit score to check how you’ve managed your debts.

• It’s a smart idea to review your own credit report and score before applying for a loan.

•For a small fee, a credit bureau will provide an instantaneous, complete online credit report and credit score that details your current debts and payment history. They will also detail what your score level means, how you compare to others and provide tips to improve the score.

•You may also receive your credit report and ensure that all the information and amounts are correct. Look carefully for any past-due or written-off amounts. Uncertainty and ambiguity on your credit report can be dangerous to your financial health.

Correcting Your Home Buyer’s Credit Score

•If you have never had a loan or credit card you can still show a good record of timely payments of your utility bills, property taxes or rent.

•You can establish minor credit relationships, such as short-term installment loans or a credit card, and maintain a record of prompt payments.

•If you have a credit problem because of an unusual situation, write a letter of explanation. Your lender may overlook a credit problem if you can give a good reason for not having made your payment.

•If you’re constantly struggling to pay your bills, seek professional help. Remember: creditors don’t want to lose money. Let them know you are having trouble with your payments. Most creditors will work out alternative payment arrangements to help you maintain a good credit rating.

Credit Tips

• Plan major purchases carefully and do not accumulate excessive amounts of debt.

• Pay down existing debts and ensure bills are paid on time, especially minimum payments on credit cards. If necessary, postpone major purchases until you can save the money required.

• Avoid large purchases before buying a house, since the added debt will affect your home buyer’s credit score and mortgage qualifications.

• Use credit responsibly. Establishing a track record of on-time payments will improve your credit rating.

• Avoid skipping bills to make other payments since missed payments appear on your credit report and create longer-term problems.

• Avoid defaulting on payments. Delinquent payments, collection items, and court judgments stay on your credit file for six years, even if you subsequently pay them.

• Save money regularly for financial emergencies. You can also arrange for credit lines to cover short-term cash flow payments, but resist utilizing them on a long-term basis.

To discuss your credit report and how you can improve your credit score directly, contact Equifax at (877) 227-8800 and the Trans Union at (800) 916-8800.

To find out more about your Home Buyers Credit Score and Our VIP Buyers Guaranteed Programs, fill out and submit the form on this page. In the “Notes” box, include a code “buyers guaranteed programs”

VIP Buyers Guaranteed Programs

1. If within one year, you are not happy with the purchased property, we’ll SELL IT FOR FREE. You pay only the buyer’s agent portion of the commission* (Conditions apply)

2. If we don’t SAVE you at least 1% on your home purchase price, on completion date we’ll pay you back 10% of our net commission* (Conditions apply)

3. Our services are COST-FREE for you. Our commissions are paid by the sellers.

To find out how you benefit from our Buyers FREE Real Estate services, go to FREE Buyers Services

Your referrals are greatly appreciated and very well rewarded. For information on how to earn $500.00* or more visit our “Referral Program” page.

Enjoy this obligation-free Home Buyers Credit Score Brochure. Thank you in advance for sharing this page with friends and colleagues on your favorite social media networks using the “share” buttons below.